MANCHESTER, NH – Fuel prices in New England continued to climb averaging almost a five-cent increase from last week. The national average is at its highest price this year and has now increased for 25 consecutive days. This increase was most prevalent in the East Coast region where refiners wrapped up seasonal turnaround resulting in significant prices increases last week.

“We’ve seen crude oil prices rising this week fueling much of the rise in gasoline prices as well the switch to more-expensive summer-blended gasoline, said Dan Goodman, manager of public affairs for New Hampshire and Vermont for AAA Northern New England.

- Vermont’s current price is $2.43 per gallon, which is 4 cents higher than one week ago, and 23 cents higher than one year ago.

- New Hampshire’s current price is $2.32 per gallon, which is 4 cents higher than one week ago and 22 cents higher than one year ago. The cheapest gas in town, according to gasbuddy.com is at Budget Gas (on South Willow and on Boynton Street) or at Maverick, also on South Willow – if you’re paying cash. Click here to scope out the cheapest gas near you.

- Maine’s current price is $2.39 per gallon, which is 2 cents higher than one week ago and 18 cents higher than one year ago.

- Massachusetts current price is $2.37 per gallon, which is 5 cents higher than one week ago and 24 cents higher than one year ago.

Oil Market Dynamics

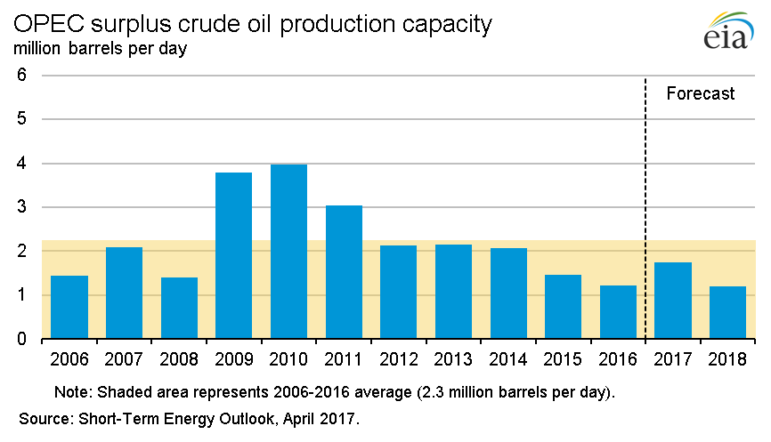

Last week, crude oil futures held onto the week’s gains closing out above $53 per barrel. Competitive prices were led by reports that OPEC and non-OPEC compliance is above 90 percent and the countries are considering extending production cuts beyond June, the original end date for the agreement reached last November. Participating OPEC countries plan to meet on May 25 to discuss how an extension of their agreement could further rebalance global oil supply and inventory levels.

Markets opened Aril 17 with less confidence, countered somewhat by growing U.S. production. The U.S. Energy Information Administration (EIA) reported a larger-than-expected decline in oil stockpiles last week showing growth in U.S. oil output. National crude oil output reached a one-year high of an estimated 9.1 million barrels per day in March this year. Last week’s Baker Hughes oil rig count report – which showed the U.S. adding 11 rigs last week, bringing the total rig count to 683 – is further evidence of increased U.S. production. Traders will continue to watch the impact that increased U.S. production has on OPEC’s efforts to rebalance the market. At the close of last week’s formal trading session on the NYMEX, WTI was up seven cents to settle at $53.18 per barrel.