Concord, NH – The New Hampshire Department of Revenue Administration (NHDRA) has launched the second phase of its new online user portal and revenue management system, providing approximately 148,000 New Hampshire taxpayers with an improved online experience. This is the largest of three total phases in NHDRA’s modernized tax collection and payment system. NHDRA, which collects more than $2 billion in taxes each year, expects the full implementation for all tax types to be complete by the end of 2021.

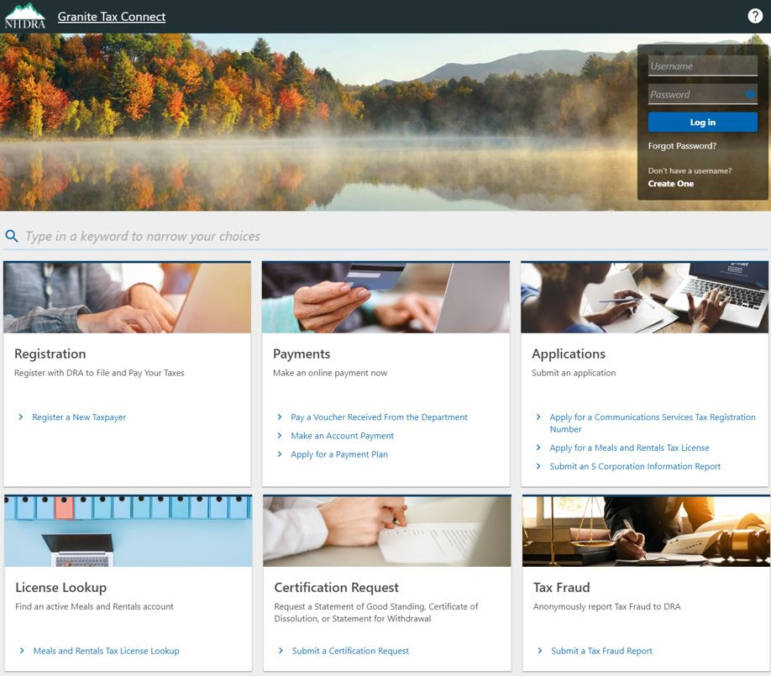

NHDRA launched phase two of the new Revenue Information Management System (RIMS) and Granite Tax Connect (GTC), its online user portal, on October 5, 2020, for taxpayers of the New Hampshire Business Profits Tax, Business Enterprise Tax, Interest & Dividends Tax, and Communication Services Tax – which equates to approximately 139,000 taxpayers. Granite Tax Connect allows taxpayers, operators and practitioners to complete tasks online, such as file taxes electronically, schedule automated online payments, schedule estimated payments, view correspondence from NHDRA, check on the status of returns, payments, refund and credit requests, web requests, and more. Taxpayers of the Meals & Rentals Tax, Medicaid Enhancement Tax, and Nursing Facility Quality Assessment, approximately 9,000 taxpayers, were included in the first phase, which launched on October 28, 2019. In less than one year, more than 6,700 taxpayers and their practitioners have enrolled in GTC.

“Our initial launch of RIMS and GTC has been an incredible success for taxpayers who have adopted GTC as their method of interacting with NHDRA, and we are excited to introduce this technology to the next group of taxpayers,” said NHDRA Commissioner Lindsey Stepp. “Beyond ease of use for taxpayers, GTC and RIMS has streamlined our processes internally, enabling us to more effectively support our taxpayers and carry out our mission of fairly and efficiently administering the tax laws of the State of New Hampshire.”

Additionally, without logging in, users can apply for a payment plan, pay from a voucher, look up a license, apply for a Meals & Rentals license and, new in phase two, anonymously report suspected tax fraud, request certifications, such as certificates of good standing and dissolution, and submit a request to add a new, or modify an existing, Power of Attorney.

“We are especially excited to offer the new Power of Attorney request function through GTC in this phase, which we know taxpayers and practitioners will find much simpler,” Stepp said. “Rather than printing, completing manually and faxing, the entire application process can be done online. Additionally, the new form will guide users through what information is required of them, and make sure those requirements are properly filled out before the request is submitted to NHDRA, which will help improve accuracy and reduce the amount of follow-ups needed between the applicant and NHDRA.”

Tax professionals and taxpayers of the Business Profits Tax, Business Enterprise Tax, Interest & Dividends Tax and Communication Services Tax can access and create a user profile on GTC by visiting https://gtc.revenue.nh.gov/TAP. Taxpayers with questions should contact NHDRA Taxpayer Services at (603) 230-5920, Monday through Friday, 8:00 am to 4:30 pm. Although extra staff will be on standby to assist with taxpayer inquiries following the second launch, taxpayers could experience longer than usual wait times as NHDRA assists users through inquiries they may have regarding GTC.

NHDRA has been working diligently with FAST Enterprises, the company contracted to develop this new technology, to prepare for this second phase of the rollout, communicating updates to taxpayers of all types, providing information on a dedicated webpage with GTC resources and conducting demonstrations. Twenty FAST Enterprises employees were relocated to New Hampshire to join the NHDRA team during implementation, which began in late 2018, and six NHDRA staff members are dedicated to the project full-time.

Phase three, the final phase, is expected to launch by the end of 2021 and will include all remaining tax types collected by NHDRA.

The technology FAST Enterprises developed to create RIMS and GTC is specifically designed to support government sector tax administration agencies, and its software is utilized in more than 50-percent of U.S. states, along with local and foreign government agencies.

More information on RIMS and GTC is available at www.revenue.nh.gov/gtc.