MANCHESTER, NH – A continuing slight increase in inventory is a good thing in New Hampshire’s impossibly tight housing market, but not enough to ease the pressure that’s having ripple effects throughout the state’s economy.

And even with a few more houses available, and the median sales price down slightly from September, it’s still a seller’s market.

The October residential market figures, released Wednesday by the New Hampshire Association of Realtors, shows 1.7 month’s inventory at the end of October.

The increase in single-family housing inventory has toggled between 1.7 and 1.9 months’ supply since June, after being less than a month from December to April.

The increase, though, doesn’t mean that the state’s housing supply issues, a problem that’s been building for a decade, will be solved any time soon, said Dave Cummings, NHAR director of communications.

Inventory is measured by how many months it would take to sell off what’s available if nothing else came on the market. A “balanced” market is five to seven months’ supply, a level it hasn’t been at for more than five years, Cummings said.

“Which means it’s been more than five years that we’ve been building toward this inventory shortage,” he said. “It’s going to take more than a few months to dig ourselves out. “

The last time there was two-months’ inventory available was July 2020, according to NHAR statistics. The numbers have been dropping in New Hampshire since 2010, when there were nearly 15,000 single-family residential homes on the market in New Hampshire. In contrast, in February there were about 1,000, a 0.8 supply. At the end of October, there were just more than 2,100, Cummings said.

The much smaller condominium market, which the NHAR also compiles monthly statistics for, follows single-family home market inventory trends for the most part. The months’ supply at the end of October was 1.3.

The ripple effects of lack of inventory go beyond real estate statistics.

“This inventory crunch and the subsequent run-up in price has put an incredible strain on the New Hampshire economy, particularly as it relates to our state’s employers and the young people who we’d like to attract and retain to fill those jobs and help us remain one of the most vibrant states in the country,” Cummings said.

Prices decrease – a little

Some other key October market statistics are:

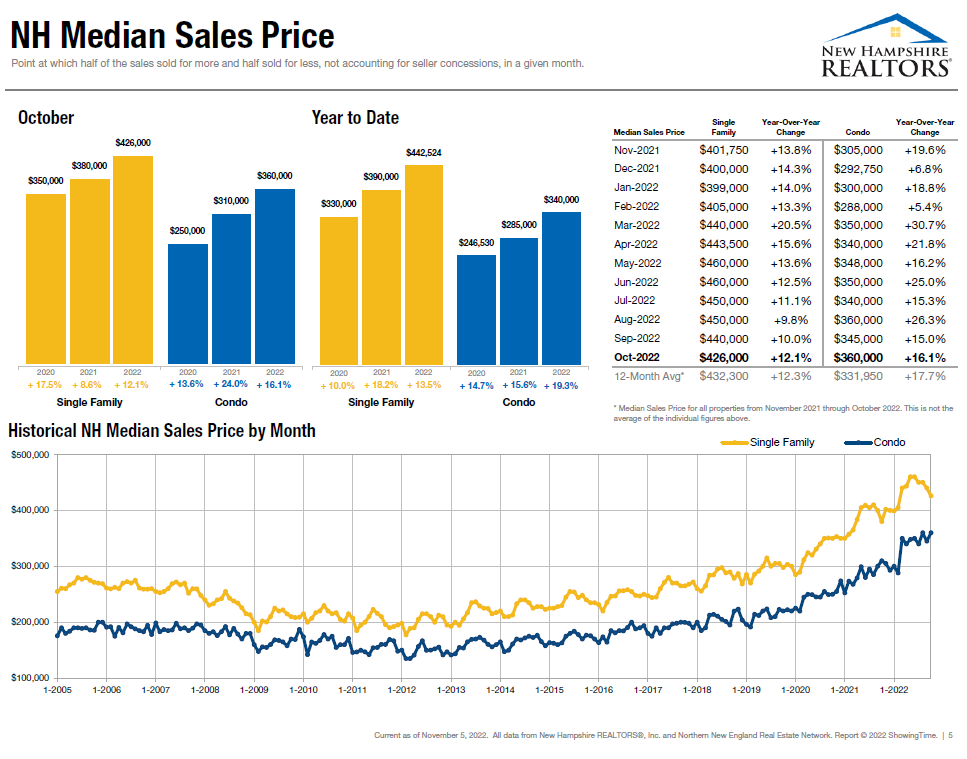

- Median sales price for a single-family home in New Hampshire in October was $426,000, up from $380,000 in October 2021, but down from $440,000 in September. The year-to-date median sales price is $442,524, 13.5 percent higher than the $390,000 year-to-date median this time last year.

- Median sales price for a condo is $360,000, up from $310,000 in October 2021, as well as up from September’s $345,000. Year-to-date median sales price for a condo is $340,000, up from $285,000 last year.

- There were 1,290 closed single-family home sales in October, down 26 percent from 1,744 in October 2021. So far this year there have been 12,305, down 14.9 percent from last year’s 14,464.

- There were 377 condo closings in October, down from 474 in October 2021. There have been 3,891 so far this year, down from 4,434 at this time last year.

- Buyers paid an average 99.7 percent of list price in October, the first time since July 2020 that number’s been below 100 percent (its highest point was 104.4 percent in June 2021). The trend so far this year is 102.6 percent, almost even with last year’s 102.7 percent. Condo buyers paid an average of 101.1 percent list price, and are on a trend to pay 102.9 percent above list this year.

- Average number of days on the market for single-family homes was 27 in October, up three days from October 2021, and up four from September.

It’s still a seller’s market, despite slight changes in trends, Cummings said.

“We seem to be in the early stages of a shifting market, but there’s still a long way to go to find balance,” he said. “A year ago, we were looking at what I would consider an extreme sellers’ market, with less than a month’s supply of inventory, and it wasn’t abnormal for a listing to bring multiple cash offers, with no contingencies and no inspections, tens of thousands of dollars over asking price, many times sight unseen.

“We’re not seeing as much of that feeding frenzy now, but it’s still a market that favors sellers.”