PORTSMOUTH, NH – From an office overlooking a bustling Portsmouth Harbor, entrepreneur Mark Galvin and his team are working to foster what he calls “the gas buddy” of health care by providing businesses and consumers with on-the-go tools to shop around when it comes to paying for common medical procedures.

“Health care costs are not only taking over our national budget but our personal budget as well,” noted Galvin, CEO of MyMedicalShopper (MMS), a company he founded in 2013. “In many aspects, the system is broken.”

When it comes to health care costs, Galvin has a point. In 1960, those costs as a portion of the economy amounted to just 5 percent. Flip the calendar to present day and most experts peg the bill at 17.9 percent of the nation’s economy, with the upward trend checking in at near or over 20 percent in 2025. Broken down even further, it amounts to over $10,000 per person in U.S. health care costs each year. Compare that to other industrialized countries and the U.S. is at the top of the leader board (Switzerland sits in second place with a per capita allocation of about $7,300). When you average the other industrialized countries, the annual spend is a little more than $5,000 per capita, meaning the United States spends about twice as much on health care.

In just about any setting, those who broach the topic of health care could find themselves in a spirited debate about funding sources, the role of government in the process, and one’s personal responsibility. While there is a broad range of opinions on the topic, there is one thing most people can agree on – it costs too much.

Galvin started MyMedicalShopper partly out of his own frustration as a business owner facing rising costs of health care.

“Historically, there has a been a lack of transparency when it comes to cost of medical procedures and services,” he said. “As a consumer, you really weren’t that involved. Your doctor prescribed a test or treatment and you went where they told you to go.”

That realization drove Galvin to seek solutions under the premise that if you provided health care shoppers with a cost comparison tool, they would make more informed choices and save money in the bargain. He added that in shopping for services, consumers also get a “retail sense of true costs” which can vary from location to location.

Galvin, who along with Christopher Matrumalo, Director of Marketing for My MedicalShopper, sat down for a chat with Medical Matters recently. They discussed health care trends, the growth in spending and how their company was working with employer groups to bend the medical “cost curve.”

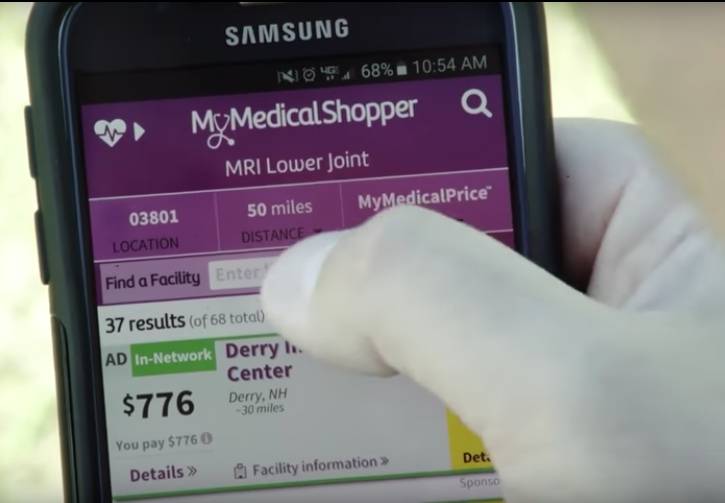

Matrumalo explained that their company works with an employer’s HR department and benefits consultants to empower employees with “the tools consumers need” to make informed health care decisions, including a price comparison tool that integrates with one’s health insurance plan to deliver personalized information through a special mobile app developed by MMS. The app also provides information on quality.

This is particularly valuable to employees who have either a high deductible plan – meaning they must spend their own money on care before the plan kicks in – or a health savings account (HSA) where one puts aside money each pay period for anticipated medical needs.

“More and more, the individual consumer is being asked to pay out-of-pocket costs,” Matrumalo says. “Our tool is providing them with the education and information they need to make those important decisions.”

He added the tool could be easily accessed via a desktop computer or mobile device.

“Portability is important,” he said. “When a patient is prescribed a test or treatment, they can literally use the tool on their phone while at the doctor’s office.”

MyMedicalShopper also provides their clients with a dashboard powered by real-time analytics of their groups’ medical claims, helping them identify patterns and trends, and make strategic decisions about their benefits. The company claims it can help businesses save as much as a third of current medical claims, which in turn, could reduce insurance premiums going forward.

By aligning tools with an increasing trend toward consumer involvement in health care purchasing, Galvin says MyMedicalShopper is responding to a growing trend: what can the individual consumer do to impact his or her wallet when it comes to the cost of health care?

“I think the cost is indeed driving innovation and hopefully solutions,” Galvin said. “The cost is also driving consumer behavior.”

The health care environment – both in NH and across the United States – does appear to be seeking to respond to rising health care costs. Over the past several years, the Granite State has seen a rise in free-standing medical/surgical facilities, walk-in or urgent care centers and a broad range of consumer-facing programs aimed at informing consumer choice when it comes to purchasing health care. Other NH companies – like Bedford-based Vitals (formerly Compass Smart Shopper) have developed programs which provide a cash incentive for members who choose a lower cost provider.

At present, MyMedicalShopper works with about 150 employer customers and is primarily concentrated in New Hampshire, Maine, Massachusetts, Connecticut and Rhode Island. The company, which works closely with local brokers and third-party administrators, employs 12 at present with plans to add to its workforce in the coming months.

Matrumalo calls MyMedicalShopper “a big data analytics company with big dreams for fixing the US health care industry. We believe that empowering consumers with true medical price transparency can drive nearly $1 trillion in annual savings, reverse the unsustainable trend of skyrocketing costs, and ultimately fix our broken health care market.”

Both Galvin and Matrumalo view the rise of health care consumerism as a good thing. “With the consumer being asked to shoulder more and more of the cost, why shouldn’t they have access to cost information. It’s their money,” noted Galvin.

To learn more about MyMedicalShopper, please visit https://mymedicalshopper.com/